51+ what debt to income ratio is needed for a mortgage

Backed By Reputable Lenders. For example if you pay 1500 a month for your mortgage another 200 a month for an auto loan and 300 a month for remaining.

What Debt To Income Ratio Is Needed For A Mortgage Tally

Ideally lenders prefer a debt-to-income ratio lower.

. Compare the Best Conventional Home Loans for March 2023. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. 4000 Debt 10000 Income 40 DTI What is a Good Debt-to-Income Ratio Ratio.

Updated FHA Loan Requirements for 2023. Web DTI measures your debts as a percentage of your income. Web The minimum credit score required to buy a house is 620.

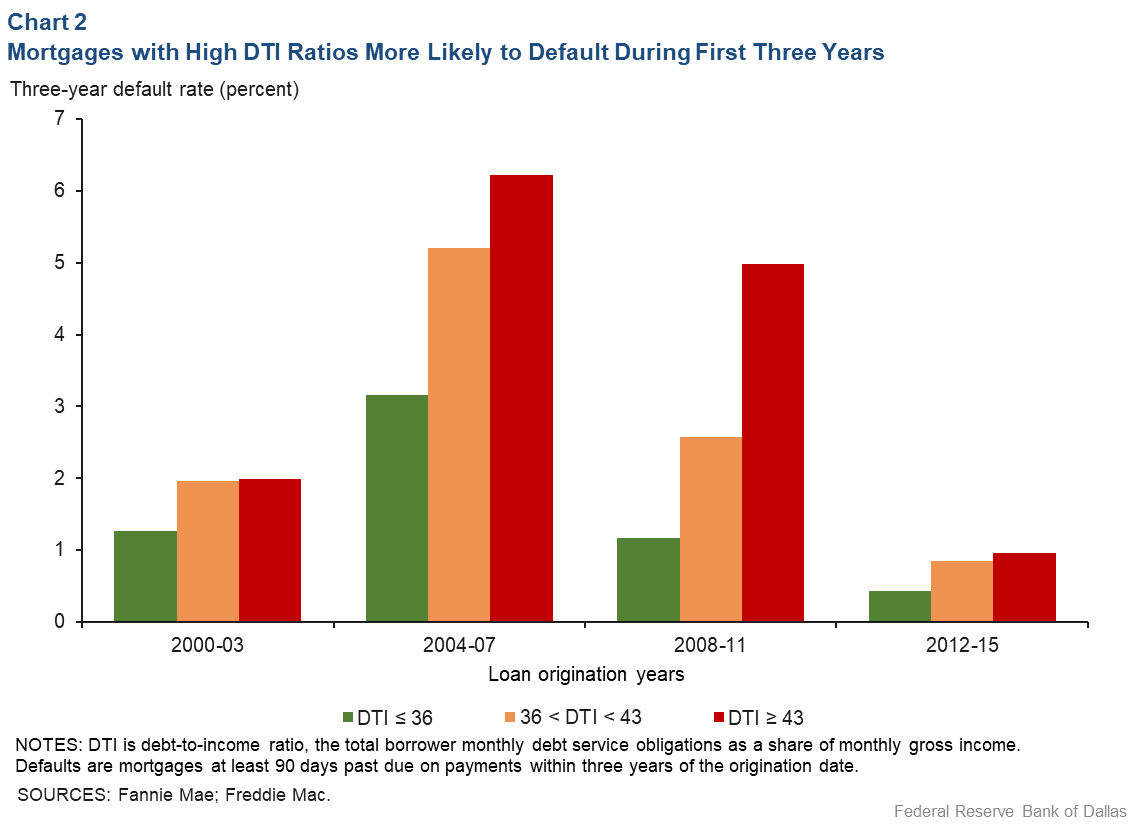

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Get Competitive Rates That Work Within Your Budget. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Check Your Official Eligibility Today. You have a pretax income of 4500 per month. You may qualify for a mortgage with a lower score if you are seeking an FHA VA or USDA loan.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. DTI ratio under 36 is. 1 2 For example.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Generally a good DTI is around 36 or.

Multiply that by 100 to get a. Ad Calculate Your Payment with 0 Down. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Ad Take the First Step Towards Your Dream Home See If You Qualify. Web This will increase your chances of getting a loan.

Web How Is Debt-to-Income Ratio Calculated. Get Terms That Meet Your Needs. Ad The Best Way To Find Compare Mortgage Loan Lenders.

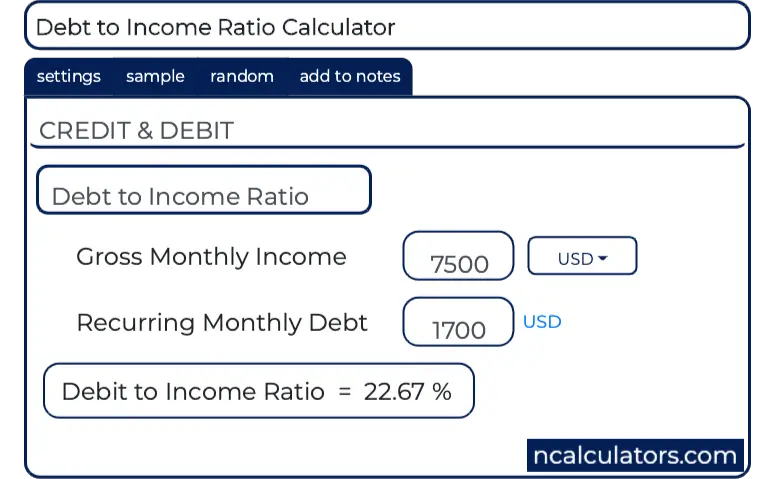

Your monthly expenses include 1200. Web DTI Debt Income. Web Debt-to-income ratio total monthly debt paymentsgross monthly income.

Total your monthly bills and divide that number by your gross monthly income or. Ad 5 Best Home Loan Lenders Compared Reviewed. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Calculating your DTI ratio is simple. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Comparisons Trusted by 55000000.

Were not including any expenses in estimating the. Apply Get Pre-Approved Today. Web For instance if your monthly debt is 2000 and your monthly gross income is 3000 your debt-to-income ratio is 6667.

Debt To Income Ratio Calculator

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Get A Loan With A High Debt To Income Ratio 2023

Calculating Your Debt To Income Ratio

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

List Of Top Personal Loan Providers In Bhalubasa Best Personal Loans Online Justdial

What Is A Good Debt To Income Dti Ratio

Debt To Income Dti Ratio Requirements For A Mortgage

Debt To Income Ratio For Mortgages Explained

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

List Of Top Personal Loan Providers In Burrabazar Best Personal Loans Online Justdial

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org